2024

BB&T recommends these types of fund so you can property owners exactly who want to stay-in their new houses getting step 3-five years otherwise expanded

The brand new Department Banking and you will Trust Company (BB&T) is actually oriented within the New york during the 1872 as the Part and you can Hadley, that’s based in Winston-salem, NC. It actually was one of the first institutions in the us to help you manage a depend on company. This new bank’s loan products are repaired- and variable-price mortgages, near to lowest-pricing options particularly Virtual assistant funds. BB&T aids borrowers interested in building, purchasing otherwise refinancing their houses.

BB&T Fixed Rate Fund

Fixed-rate funds are pretty straight forward and simple-to-learn a way to get property. Individuals who found steady increases within their earnings through the years is actually a candidates to have repaired-price financing.

This type of financing are available in 29- otherwise 15-12 months terms, for choosing or refinancing homes. Budgeting and you may planning for an individual’s economic future end up being slightly easier whenever costs is actually uniform, and this refers to a beneficial financing style of so you can secure whenever interest rates are reasonable, while the they’ll certainly be locked in the.

BB&T Variable Rates Money

Adjustable-speed mortgages (ARMs) are a great choice for residents that simply don’t desire to be closed towards the one price immediately. There are numerous grounds somebody may want to has a variable payment. For-instance, some one expecting earnings expands soon can benefit away from an in the beginning low-rate.

Pregnant a house product sales otherwise refinancing is yet another high reasoning in order to go with an arm in the place of a mortgage. BB&T also provides step three, 5, eight and you will ten year Sleeve selection.

BB&T The fresh Structure Finance

Anybody to acquire a great deal and you can funding design out-of an alternate home thereon property can sign up for a property-to-long lasting loan. It mortgage choice is as well as suitable for capital highest-measure home improvements. These financing arrive toward an initial- and enough time-title foundation and merge a single-year build loan that have a real estate loan since the the fresh new building is carried out.

BB&T Va Fund

The fresh new U.S. Veterans Management guarantees another family of mortgage brokers to own active-obligations armed forces players or veterans, Federal Guard officials otherwise set aside participants. These types of mortgages are different from other products where needed lower if any off money and just have smaller borrowing from the bank and you may income criteria.

Offered by BB&T just like the 15- otherwise 29-12 months repaired-rates loans, Va fund was suitable for purchasing otherwise refinancing a house filled of the candidate and hold the entry to present money toward the newest down payment.

BB&T USDA Money

This new You.S. Department away from Farming accounts for a different sort of brand of https://availableloan.net/loans/5000-dollar-payday-loan/ loan created specifically for all of us looking to relocate to rural areas. These financing supply the particular independency really possible property owners worth, that have up to 100 percent investment readily available and you may provide financing recognized into new down payment. As opposed to Va financing, USDA fund perform need mortgage insurance rates.

BB&T FHA Loans

This new Federal Construction Power is an additional authorities service that gives loans with reduced criteria to consumers who don’t qualify for standard repaired-rates mortgage loans otherwise Arms. Such as for instance USDA finance, FHA financing need home loan insurance coverage.

BB&T Cash-out Refinancing Loans

Home owners with reduced some of their mortgages and need guarantee to settle personal debt otherwise build a primary get otherwise resource can change in order to bucks-aside refinancing. This action relates to taking out fully a different mortgage getting a greater number and obtaining the difference given that security.

As the financial rates are generally less than desire towards the debt, it a sound enough time-term financial technique for particular consumers.

BB&T Financial Apps

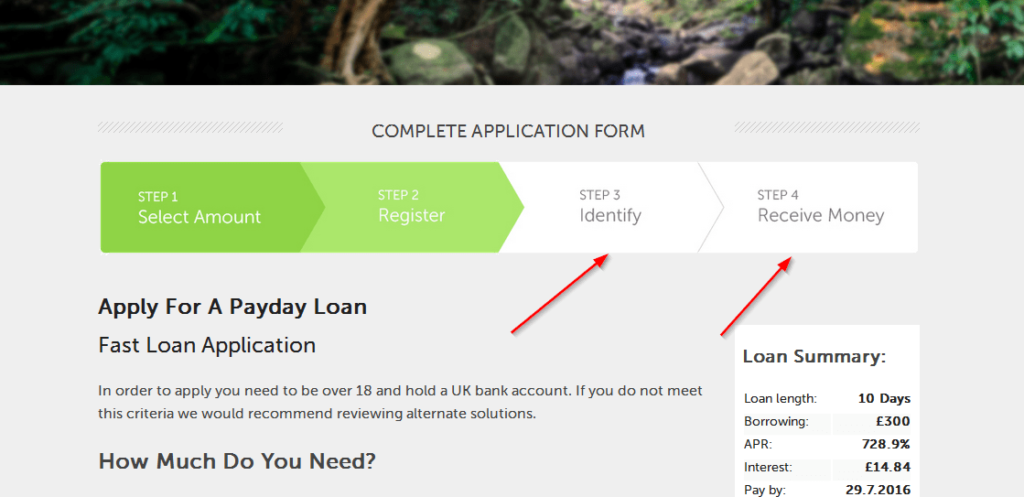

There are certain convenient units having residents with the BB&T website. The lending company does offer an internet mortgage form which fits for each and every representative that have an experienced BB&T mortgage officer. The web based prequalification process is designed not to ever apply to your credit score and you will uses monetary concerns to determine whether they be considered having a particular sorts of financing and you will household spending budget.

- Contact information and most recent residence

- Precise location of the domestic involved

- A position reputation and you can general financial predicament

The complete financial processes is completed in an effective paperless setting for the BB&T site, that have electronic signatures standing set for real document signing. The banknotes one their procedure were quick, and certainly will bring only thirty days, more less than the new 49-big date average quoted by Ellie Mae for everybody financial approvals.

The bank was licensed of the Winston-salem Better business bureau, the new branch nearest in order to their head office. It has got acquired harsh studies out-of people through the Bbb and you can maintains an assessment get of just one/5. The financial institution revealed into the 2016 that it was part of an enthusiastic $83 million money settlement on the users out-of FHA financing.

However, the procedure involved no entry from liability, and also the lender launched it was wanting to recover $70 billion inside a connected matter.

BB&T Recommendations and Grievances

Centered in 1872 from inside the North carolina, BB&T is a financial and you can Trust offering sixteen Southern and you can Midwestern says, and Section regarding Columbia. Their Winston-salem head office are certified from the local Better business bureau with an a+ rating. It has got held which accreditation as the 1974 features a consumer comment score of just one/5.

It’s gotten 745 Bbb complaints and you will 61 analysis. The bank answers grievances against it, some of which are thought resolved while others only responded. The financial institution responds so you’re able to its ratings, however in public areas, merely saying that try is at over to disappointed users.

BB&T Financial Qualifications

BB&T even offers multiple option investment choices for consumers exactly who meet an effective variety of official certification. Somebody armed forces professionals, experts, the individuals residing rural elements otherwise whom be eligible for FHA assistance also can qualify for this type of special selection qualified as a consequence of bodies providers. BB&T also offers an assessment out-of credit rating mounts.